Building a secure financial future requires more than just accumulating wealth. It involves implementing strategies to preserve your possessions from unforeseen circumstances. A well-designed wealth defense plan can mitigate the consequences of threats, providing you with lasting peace of mind.

Consider these essential steps to fortify your financial standing:

* Spread your investments across different asset classes to reduce risk.

* Regularly review your portfolio and make modifications as needed to match your evolving financial goals.

* Explore insurance coverages that can shield you from potential losses.

By taking a proactive strategy, you can secure your financial future and live greater confidence.

Secure Your Legacy: The Wealth Academy Guide

Are you aspiring to establish a lasting financial legacy for your family? The Wealth Academy Guide offers comprehensive strategies to maximize your wealth and provide its preservation. Our specialists will assist you through the complexities of wealth accumulation, helping you attain your financial aspirations.

- Explore powerful strategies to accumulate your assets.

- Create a personalized wealth plan tailored to your unique circumstances.

- Gain essential knowledge about investment, estate management.

Never overlook this opportunity to secure your legacy. Enroll in The Wealth Academy Guide today and begin on a journey towards financial prosperity.

Boost Your Assets with Smart Protect Wealth Max

Smart Protect Wealth Max offers a sophisticated methodology to secure your significant assets. This comprehensive platform utilizes the most current tools to reduce risk and amplify your investment prosperity. With Smart Protect Wealth Max, you can sleep confident that your portfolio is in good hands.

- Gain crucial insights into your economic status

- Implement a tailored strategy to achieve your individual goals

- Enjoy exceptional protection for your assets

Bobby Casey Global Wealth Protection: Expert Insights

In the dynamic realm of global/international/worldwide finance, safeguarding your wealth requires a meticulous and strategic/proactive/comprehensive approach. Bobby Casey, a recognized expert/authority/leader in asset protection/wealth management/financial strategy, offers invaluable insights/guidance/strategies to help individuals and families secure/preserve/protect their assets on a global scale. With his extensive experience/knowledge/expertise in international tax laws/global financial regulations/cross-border investments, Bobby Casey empowers/guides/assists clients in navigating the complexities of wealth management/financial planning/asset allocation to achieve their long-term financial goals/objectives/aspirations.

- Implementing innovative wealth transfer techniques for generational prosperity.

- Conducting thorough due diligence on international investments to ensure safety and security.

- Providing ongoing portfolio monitoring and adjustments to adapt to market fluctuations.

Wealth Shield: Defending Your Freedom

Your gains are the foundation of your future. But in today's volatile world, safeguarding your wealth is more crucial than ever. Shifting economic factors and unforeseen circumstances can quickly erode your financial security. That's where a robust Wealth Shield comes into play.

A strategic strategy designed to mitigate risk and preserve your wealth over the long term, is essential for achieving lasting success.

It's not just about saving; it's about building a layered defense against protect your health data potential threats and ensuring that your hard-earned value are preserved for generations to come.

Let's explore the key strategies of an effective Wealth Shield, empowering you to take control of your financial outlook.

Preserving Your Wealth: The Ultimate Manual

Embark on a journey to navigate the complexities of wealth management with our comprehensive resource. Discover proven strategies to safeguard your earnings from unforeseen circumstances. Our expert insights will enlighten you with the tools to sustain lasting wealth. From estate planning to asset {management|, we provide a holistic approach to conserve your hard-earned assets for generations to come.

- Learn the fundamentals of wealth preservation.

- Explore effective strategies to minimize risk.

- Formulate a personalized wealth plan aligned with your goals.

Mastering Wealth Protection: A Comprehensive Approach

Preserving your wealth requires a strategic and multifaceted method. It's not merely about accumulating funds, but also about protecting them from unforeseen circumstances. A comprehensive wealth protection plan should encompass various elements, including investment strategies.

- Establish a secure financial plan that aligns with your goals.

- Spread your investments across different asset classes to mitigate risk.

- Employ coverage options to safeguard against potential damages.

- Evaluate your plan regularly and make modifications as needed.

By taking a proactive and informed approach to wealth protection, you can create a more secure and prosperous future for yourself and your loved ones.

Safeguarding Your Fortunes: Essential Practices

Protecting your assets is paramount to achieving long-term financial security. Implementing sound strategies can help you mitigate risks and preserve your wealth for future generations. A well-diversified asset allocation across various asset classes, such as stocks, bonds, and real estate, can help reduce volatility and enhance returns over time. It's essential to conduct thorough due diligence before making any investments, researching the underlying fundamentals and understanding the potential risks involved. Regularly evaluate your portfolio performance and make adjustments as needed to align with your goals. Furthermore, consider implementing strong safeguards to protect your assets from theft or fraud. This includes using secure passwords, monitoring your accounts regularly, and being cautious about sharing sensitive information online.

Finally, it's crucial to seek professional guidance from a qualified financial advisor who can provide personalized recommendations tailored to your specific circumstances and risk tolerance.

Constructing Financial Fortress: Securing Unbreakable Wealth Shelter

Your financial future shouldn't be left to chance. A robust financial plan isn't just about accumulating assets; it's about strategically managing your resources to weather unforeseen challenges and cultivate lasting wealth. By implementing a disciplined approach, you can establish a financial fortress that stands strong against market storms.

- Spread your investments across various asset classes to minimize risk.

- Build a comprehensive emergency fund to provide a safety net during unexpected events.

- Maximize tax-efficient investment strategies to conserve more of your hard-earned wealth.

Remember that building a financial fortress is an ongoing process. Periodically review and adjust your plan to accommodate evolving circumstances and seize new opportunities for growth.

Securing Wealth Protection Strategies for Success

Building a secure financial future requires more than just growing wealth. It's crucial to establish effective wealth protection strategies that preserve your assets from unforeseen circumstances.

A well-crafted plan can minimize risks and guarantee peace of mind, enabling you to devote on your long-term aspirations.

Uncover the key elements of a comprehensive wealth protection plan:

* Risk Spreading

* Protection Policies

* Legacy Management

* Tax Optimization

Keep updated about the latest trends in wealth management to implement intelligent decisions that preserve your financial well-being.

Safeguarding International Holdings

In today's interconnected world, your wealth extends across borders. This presents both opportunities and concerns. To effectively navigate this complex landscape, you need a robust approach to global asset preservation. A team of dedicated specialists can assist you in creating the right solutions to defend your assets from a range of potential threats.

Moreover, navigating international legal and regulatory frameworks can be demanding. Our team possesses the expertise and experience to confirm your assets are aligned with applicable laws and standards in each jurisdiction.

Ultimately, our goal is to provide you with assurance knowing that your global wealth is effectively protected.

Let us be your trusted collaborator on your journey to financial security.

The Art of Wealth Preservation: Timeless Principles

Cultivating lasting wealth is a journey that transcends temporal trends. It demands a steadfast commitment to intrinsic principles that have survived the test of time. This involves a strategic approach, encompassing calculated investment strategies, asset allocation, and a profound understanding of financial principles. By embracing these timeless principles, individuals can secure a financial foundation that provides long-term well-being.

- Employ your financial resources strategically.

- Diversify your investments across industries.

- Control expenses and foster a prudent lifestyle.

Bobby's Blueprint for Global Wealth Security

Achieving global wealth security is a difficult task in today's unpredictable market. However, Bobby Casey, a renowned guru in the field of finance, has outlined a comprehensive system designed to help individuals secure their wealth on a worldwidescale. Casey's methodology is based on a multi-faceted set of principles that prioritize diversification, risk management, and long-term investment approaches.

- Essential to Casey's system is the need of

- spreading your investments across a broad range of asset classes.

Maximizing Your Wealth: Protection and Growth Strategies

Securing his financial future requires a comprehensive approach that encompasses both protection and growth. It's crucial to safeguard holdings against unexpected risks while simultaneously implementing strategies that foster consistent wealth accumulation. A well-diversified portfolio, encompassing real estate, can help mitigate risk and provide a solid foundation for long-term growth. Additionally , exploring alternative investments like commodities can further enhance returns. Regularly evaluating your financial plan and making tweaks as needed ensures you stay on track to achieve your financial goals.

Unlock Your Financial Future: Wealth Academy

Are you ready to secure lasting financial prosperity? Wealth Academy is here to guide you on your journey toward abundance. Our expert-led programs provide the knowledge you need to master in today's dynamic financial landscape. Through practical learning, you will uncover insights into budgeting, craft a personalized financial plan, and strengthen the discipline necessary for long-term success.

Wealth Academy offers a diverse range of workshops to suit your individual needs and objectives. Whether you are just starting your financial journey or seeking to maximize your current approaches, we have the perfect program for you. Our committed instructors share real-world experience and a deep knowledge of financial principles, ensuring that you receive the highest quality guidance.

- Join Wealth Academy today and begin on a transformative journey toward financial resilience

- Empower yourself with the knowledge to create your dream financial future.

- Tap into a world of financial potential and succeed on your own terms.

Invest in Protection: Safeguarding Your Future

Your tomorrow is precious and worthy of safeguarding. In a world filled with challenges, it's essential to allocate in strategies that shield your well-being. Don't delay until it's too late. Start planning today for a more stable future.

- Assess your current circumstances.

- Recognize potential dangers.

- Develop a comprehensive plan.

Smart Protect Wealth

At Smart Protect Wealth, we believe with knowledge comes power. That's why we're dedicated to sharing you the tools you need to achieve strategic decisions about your wealth. We understand why navigating the world of finance can be difficult, and we're here to assist you every step along the way.

- Understand about different investment approaches

- Create a personalized financial plan

- Protect your assets for the future

Your team of experienced financial advisors is passionate to helping you achieve your financial goals. Contact us today to book a consultation and start your journey to wealth.

The Wealth Shield Protocol: The Secure Foundation

In today's volatile economic landscape, safeguarding your assets has never been more crucial. Enter the path to financial security with The Wealth Shield Protocol, a comprehensive system designed to protect and Grow your wealth. Our protocol leverages cutting-edge Strategies to mitigate risk, Streamline returns, and provide you with unwavering peace of mind.

- Utilize industry-leading encryption protocols to safeguard your sensitive information.

- Allocate your investments across a range of Sectors to minimize exposure to market fluctuations.

- Analyze market trends and economic indicators to make informed Choices.

With The Wealth Shield Protocol, you can establish a robust foundation for your financial future, ensuring that your wealth is Protected for generations to come.

Protecting Your Hard-Earned Assets: Expert Advice

Acquiring wealth requires effort. Once you've built your financial success, it's crucial to safeguard those possessions from unforeseen risks.

An effective plan involves a multifaceted blend of measures. First, evaluate your current investment {position|. Then, seekguidance from qualified advisors such as financial advisors who can provide specific advice based on your individual circumstances.

- Establish a comprehensive protection strategy to mitigate the effects of potential {events|.

- Diversify your holdings across different investment classes to reduce overall exposure.

Regularly evaluate your {financialstrategy and make necessary adjustments to ensure it continues aligned with your evolving objectives. Remember, proactively managing your assets is essential for protecting your hard-earned success.

Building Security for Your Future Wealth

Securing your wealth is paramount to achieving lasting financial independence. A robust plan that prioritizes protection of your capital can help you navigate fluctuating market conditions and ensure your hard-earned money serves its purpose. By implementing sound financial practices, you create a resilient portfolio that can weather economic turbulence and eventually propel you towards your goals.

- Assess your comfort level with market fluctuations.

- Seek professional guidance from a qualified financial advisor.

- Continuously monitor and adjust your portfolio

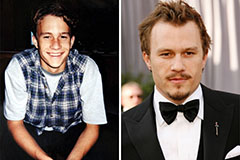

Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!